Part 2: How COVID19 is affecting digital merchants

March 18, 2020 by Paul Byrne

NOTE: This is the 2nd article in a series on COVID19 from a digital commerce perspective. Additional context is available in Part 1.

Update from Italy - Spoiler Alert - Not Good News

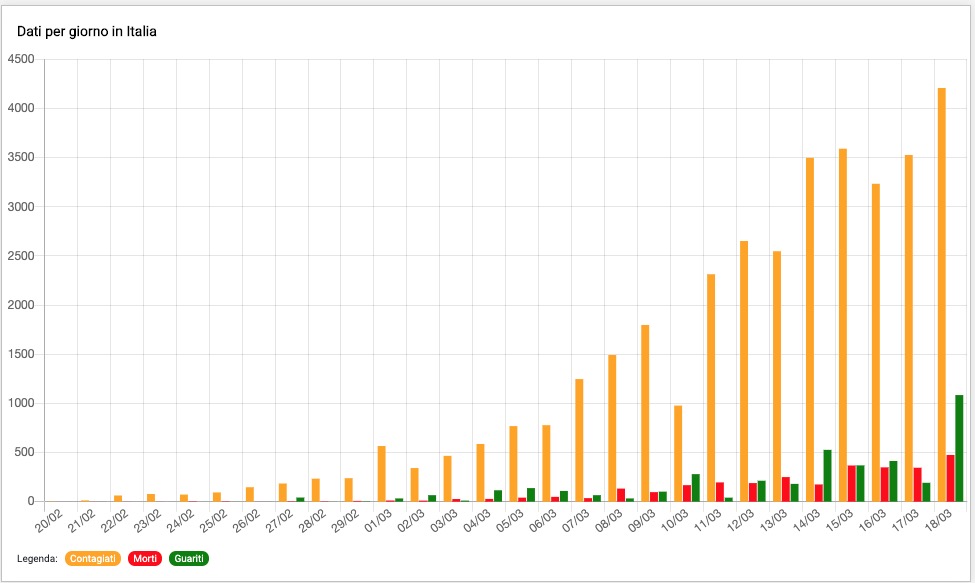

Record recoveries and new infections

As mentioned in Part 1, Italy is a great source of guidance for the US in part because they have a good health system and, like the US, failed to capitalize on advance notice.

Unfortunately, the past two days have been rough. What looked like progress appears to have been wiped out by today’s and yesterday’s bad news. Not only has infection spread to the south, but Lombardy - Italy’s ground zero - has seen an uptick in new infections.

Leaders in the Lombardy region are struggling. Bergamo is unable to source enough coffins for the dead and have mandated cremation, but, even the ovens cannot keep up. At the same time, leaders in Milan complain that people are still gathering at parks and public spaces in large numbers.

The south has started to see local spreading. Several towns have implemented Wuhan-style lock downs in order to quell the spread.

One bright spot is that we are seeing more people confirmed recovered, though that may simply be a function of the passing of time rather than an uptick in the heal rate.

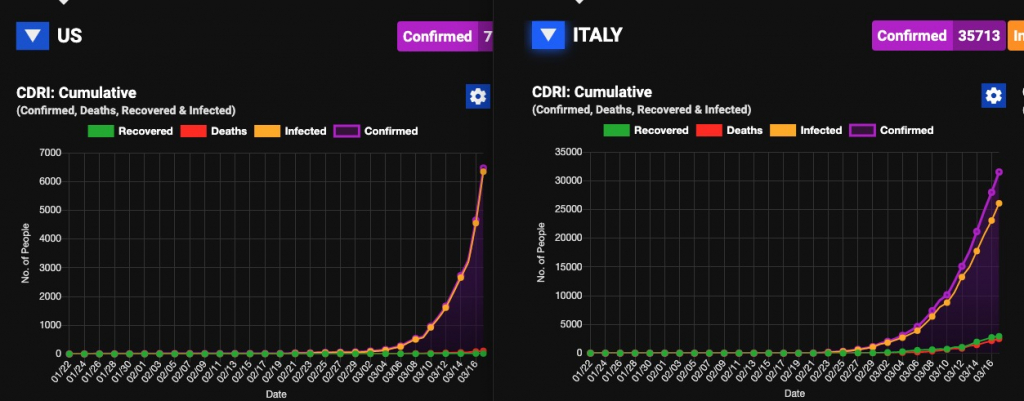

In less than a month, Italy has progressed from 0 infected to 35,000.

In the US we currently don’t know how many we have due to the dearth of testing. Estimating roughly with the available data and adjusting for population, if we see the same rise in the US we’ll have 175,000 cases by the end of March. With the current growth rate in the US, more than doubling each day, simple match indicates we will have more than 100,000 cases in less than 5 days.

We must spread the news on social distancing or we will be worse off than Italy.

Visual comparison of the US and Italian infection curves.

Digital merchants in the COVID19 crisis

Surprisingly, merchants have experienced and weathered the effects of the crisis in a variety of ways. Of course they are affected by social distancing, work from home, quarantined staff and the issues everyone is dealing with.

Merchants whose business is up

Many Business-2-Consumer merchants are seeing upticks in business in a variety of ways. One B2B / B2C merchant selling home and industrial food processing equipment reported a 20% year over year uptick driven by B2C sales.

Some growth is driven by panic buying and will be short-lived.

We have had a run on certain items such as disinfectants, cleaners….the usual suspects, so we are in touch with suppliers daily to see what items are still available. Gloves is probably the next thing to have a run on.

B2B Merchant in retail supply

That same merchant, however, reported supply-chain issues.

All hand sanitizers, disinfectant wipes and sprays are all OUT. To anyone. Manufacturers have told our suppliers that all inventory will be sent to hospitals and health care facilities first. Consumer market may not see these items until April.

Another B2B merchant, in retail supply to gift shops reported that site traffic and sales have essentially halted. With people social distancing they simply aren’t visiting those kinds of shops.

A merchant supplying industrial and workshop equipment and supplies says online sales are holding but they are hoarding cash in anticipation of a sizable recession.

Finally, a supplier of holiday decor and specialty merchandise reported factories in China were working at about 80% capacity now so they feel the timing was less cruel to their business.

There was a CNN story about people trying to brighten spirits by using xmas lights on their house again to be festive at night…. We are trying to figure out how to be a part of that story as we speak.

Holiday specialty merchant

Where the opportunities and gains lie for merchants

Many consumers that don’t regularly shop online are forced to do so for the time being. Some of our merchants are expecting to gain share post-crisis from brick-and-mortar retail as habits shift and ecommerce becomes the new normal.

Others see an opportunity to increase sales in the short term of items that are substitutes for ‘crisis’ items. Anything that can be used for disinfecting and cleaning (spray bottles you can mix your own cleanser in, for example) is in big demand. Shop towels and cleaning rags are selling out as paper towels disappear. Even ‘joke’ toilet paper is selling off the shelves.

Others see a short-term opportunity in converting inventory. Sysco and other restaurant food supply vendors are suffering dramatically. While these suppliers cut back on purchases of produce and fresh items they still have excess stock of canned goods, restaurant small wares, even food preparation clothing. Creative merchants are purchasing, repackaging and selling these items directly to consumers.

Finally, many merchants are looking to the future and adding items to their list that will be part of the new normal, at least for the near future. Masks, long term food storage, home workout equipment, even board games for keeping kids entertained are in their sights.

Personal service and supplies hit the worst

Our hearts go out to the owners and employees of hotels, spas, salons, restaurants, movie theaters, entertainment venues, sporting arenas, dental offices, and the many, many businesses hit so dramatically.

Others affected are less obvious like door-to-door sales, retail bank locations, corporate training, phone repair and so many more. Even the mighty Uber (and Lyft) has had to completely suspend some services like pooled rides all while dealing with new rules in some locations requiring them to pay drivers who are ill.

Supply to those industries from hair-cutting and salon supplies to dental office furnishings to small bags of pretzels sold to airlines are taking a beating.

Bright spots on the horizon

I truly believe that the resulting recession (and there will be one) will be more about numbers than structural. It will certainly expose weak spots in our economy.

Coming uptick in US manufacturing and B2B merchants

If new legislation requires hospitals, the military, school districts, local governments and others to diversify their supply chain this will create new opportunities for US suppliers. For example, about 90% of critical medicine is supplied by China today while a decade ago it was less than 20%.

Large corporations will reevaluate their supply chain vulnerabilities. If they are smart they will include smaller suppliers in a variety of markets. I’m sure some consultant at McKenzie or Bain is already doing the math on this one.

Potential increase in home ownership

The reduction in interest rates may not last long but it certainly has the potential to help some buyers, especially those whose jobs are stable in a crisis (e.g., government employees) to refinance.

Long term decrease in pollution

Transportation, including commuting is one of the key drivers of pollution. Companies are learning how to expand remote work and work-from-home. After the crisis, many companies may discover that letting employees work from home, even if just a day or two each week, has cost and efficiency benefits.

While our company is definitely taking a productivity hit from social distancing, I don’t know how much of it is due to general disruption like having to care for kids out of school and our inexperience with it. We will learn how to handle this better. A small decrease in commuting can yield a large decrease in air-borne particulates, asthma and other respiratory conditions.